What Is an Approved Scanning Vendor (ASV) – And Why They Matter for PCI DSS 4.0.1

Introduction – Clarifying the Role of ASVs

For organizations that handle payment card data, compliance with the Payment Card Industry Data Security Standard (PCI DSS) is mandatory. Yet even for security professionals, some parts of the framework can feel confusing. One of the most common areas of uncertainty is the Approved Scanning Vendor (ASV).

Most businesses know they need quarterly scans, but questions quickly follow: What exactly is an ASV? How are they different from a Qualified Security Assessor (QSA)? What do they provide beyond a scan report? And what requirements do they help meet under PCI DSS 4.0.1?

This article unpacks the role of ASVs in PCI compliance, explains how they fit into the broader ecosystem of PCI professionals, and highlights what to consider when selecting one.

What Is an Approved Scanning Vendor (ASV)?

An Approved Scanning Vendor (ASV) is a company authorized by the PCI Security Standards Council (PCI SSC) to conduct external vulnerability scans. These scans are designed to test systems and networks from the perspective of an external attacker.

The process is non-intrusive but thorough: the ASV’s tools scan externally facing IP addresses, domains, and other in-scope assets to identify vulnerabilities that could be exploited. Afterward, the ASV issues an Attestation of Scan Compliance (AoSC), the official document confirming whether the environment has passed or failed.

The AoSC is not optional. It is part of the evidence organizations submit to their acquiring banks or QSAs to demonstrate compliance. Importantly, only an ASV can issue it – internal scans or scans from non-approved tools cannot substitute.

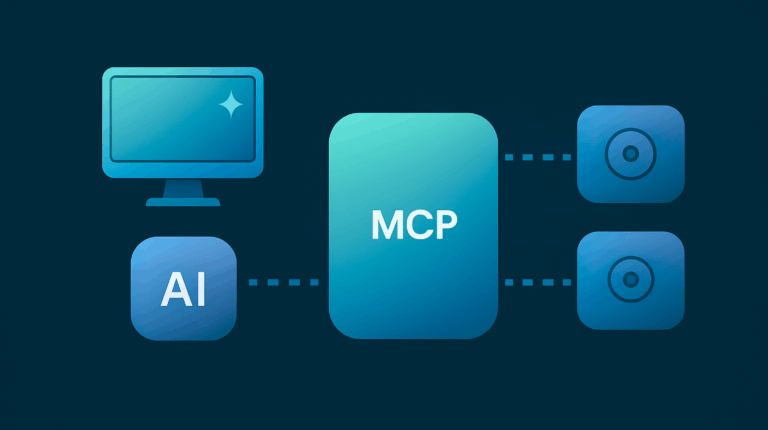

How ASVs Differ From Other PCI Professionals

PCI DSS compliance involves several different roles, and it is easy to conflate them. Each professional has a distinct scope:

– Qualified Security Assessors (QSAs) are licensed by PCI SSC to perform full PCI DSS assessments. They review Self-Assessment Questionnaires (SAQs), conduct on-site audits, and issue Reports on Compliance (ROCs).

– Approved Scanning Vendors (ASVs) are responsible specifically for external vulnerability scanning. They cannot issue ROCs but are the only ones authorized to provide the AoSC.

– Internal Security Assessors (ISAs) are employees trained to perform internal self-assessments. They help organizations prepare but cannot issue AoSCs or official ROCs.

– PCI Forensic Investigators (PFIs) are specialized firms approved to investigate cardholder data breaches.

In short, the QSA is the auditor, while the ASV is the external scanner. Both are typically required: the QSA or SAQ validates the overall compliance posture, while the ASV provides quarterly attestation that external vulnerabilities are being managed.

What Services Do ASVs Provide?

At their core, ASVs deliver quarterly vulnerability scans and the resulting AoSC. But in practice, their role often extends further. A typical ASV service includes:

– Quarterly scanning of all in-scope external IPs and domains, at least once every 90 days.

– Issuance of the AoSC after passing results, which is then provided to acquiring banks or included with an SAQ.

– Rescans to confirm remediation efforts after vulnerabilities are addressed.

– Remediation support, offering explanations of findings and guidance on fixes.

– SAQ assistance, in some cases, where ASVs provide scan evidence needed for merchants completing self-assessment.

Many ASVs also offer complementary services—such as penetration testing or continuous monitoring—but these go beyond the strict requirements of PCI DSS. The critical point is that only ASVs can provide the quarterly scanning attestation required for compliance.

What Requirements Do ASVs Fulfill Under PCI DSS 4.0.1?

The PCI DSS 4.0.1 standard emphasizes continuous security testing and validation. ASVs directly support several key obligations:

– Requirement 11.3.2 – External Vulnerability Scanning: All external systems in scope must be scanned quarterly by an ASV. High-risk vulnerabilities must be remediated and rescanned until passing.

– Requirement 11.3.2.1 – After any significant change, external vulnerability scans must also be performed by qualified personnel. In many cases, organizations use their ASV for this step to maintain independence.

– Attestation of Scan Compliance: The AoSC provided by the ASV is official evidence of scanning compliance.

– Support for SAQs: Merchants completing certain SAQs must attach the AoSC to validate that required scans were performed and passed.

Without a passing AoSC from an ASV, an organization cannot validate compliance with the external scanning requirements of PCI DSS.

Why Quarterly Scanning Matters

Quarterly scanning is more than just a checkbox exercise. External vulnerabilities change constantly as new threats emerge, new systems are deployed, or patches are missed. Scanning every 90 days ensures that organizations catch issues before they become exploitable risks.

Just as importantly, the PCI SSC requires that scans be conducted by an independent, approved entity. This independence adds credibility: an ASV has no incentive to overlook vulnerabilities, ensuring results are objective and trusted by acquiring banks and card brands.

How to Choose an ASV

While every ASV is authorized by PCI SSC, the experience they deliver can differ. When selecting an ASV, organizations should consider:

– Approval status: Always verify that the ASV is listed on the PCI SSC’s current ASV list.

– Reporting clarity: Reports should be accessible and actionable, not filled with unnecessary jargon.

– Rescan policy: Some ASVs charge extra for rescans, while others include them. Given that remediation and rescanning are often necessary, this can significantly affect cost.

– Support availability: Access to knowledgeable engineers who can explain findings is invaluable, especially for smaller organizations without large security teams.

– Integration with other needs: While not mandatory, some organizations prefer ASVs that also offer penetration testing or other security services, reducing the need for multiple vendors.

Ultimately, the best ASV is the one that not only meets compliance requirements but also helps the organization improve its overall security posture.

Conclusion – The Role of ASVs in PCI Compliance

An Approved Scanning Vendor is a cornerstone of PCI DSS compliance. Their role is specific but vital: performing external vulnerability scans, identifying risks, and issuing the Attestation of Scan Compliance required for validation.

ASVs are not the same as QSAs or other PCI professionals. Each has a distinct role, and together they ensure that organizations meet the technical and procedural requirements of PCI DSS 4.0.1. Without a passing AoSC from an ASV, compliance with external vulnerability scanning requirements cannot be achieved.

For organizations handling payment card data, working with an ASV is not just about checking a compliance box. It is about maintaining visibility into external vulnerabilities, ensuring accountability through independent attestation, and building confidence with acquiring banks and customers alike.