Payment Processors White-Label PCI

Boost your Payment Services Revenue with Branded PCI Compliance Scanning Solution

SECURING OVER 1000+ BUSINESSES WORLDWIDE

SECURING OVER 1000+ BUSINESSES WORLDWIDE

Payment Processors White-Label PCI

Protect Customers Data

As a Payment Processor, you are responsible for ensuring that your Merchants’ transactions are secure and compliant with the Payment Card Industry Data Security Standard (PCI DSS). By offering our White-Label PCI ASV Scanning solution to your Merchants, you can provide them with the tools they need to protect their customers’ data and meet the requirements of PCI DSS. By offering our White-Label PCI ASV Scanning solution to your Merchants, you can help them stay compliant and secure while also providing your organization with a profitable revenue stream. Our White-Label PCI ASV Scanning solution is designed to meet all the PCI Security Standards Council requirements and can be customized with your company’s branding.

Improve Customer Loyalty

By offering a comprehensive scanning service that is recognized by industry experts, you can differentiate your business from your competitors and improve your customer loyalty. You can now offer a high-quality, comprehensive PCI scanning service that is regulated by the PCI Council, and is specifically tailored to the unique needs of your Merchants. Our solution is easy to use with a self-managed web-based scanning portal or through our optional Application Programming Interface (API). This allows your Merchants to quickly schedule and run security scans without the need for technical expertise. This can help them identify any vulnerabilities that may exist in their systems, including malware infections, SQL injection attacks, and more. Help your merchants save time and money by identifying vulnerabilities before they can be exploited by cybercriminals.

Improve Security Posture

We provide threat intelligence and signature updates consistently updated from multiple security sources to protect against emerging threats and vulnerabilities. This means that your Merchants can stay ahead of the curve and protect their systems from the latest threats. In the event that any vulnerabilities are identified, our detailed remediation steps can assist your Merchants with resolving them quickly and efficiently. This will help them maintain compliance with PCI DSS, avoid fines, and maintain the trust of their customers. Offer PCI scanning as an added service to your Merchants, and generate additional revenue streams while also improving your customers’ security posture.

Safeguard Data and Achieve Compliance

Our White-Label PCI ASV Scanning solution can help you safeguard your Merchant’s data achieve compliance with PCI DSS, which is essential for any business that accepts credit card payments. This will also help you differentiate yourself from your competitors and increase customer loyalty. Having your own White-Label PCI ASV Scanning solution, is an essential tool for Payment Processors who want to provide a secure and compliant environment for their Merchants. By offering this required compliance service, you can differentiate your business from your competitors, generate additional revenue streams, and improve your customers’ trust and loyalty. Contact us today to learn more about how we can help you grow your payment processing business while providing essential security services to your Merchants.

Protect Customers Data

As a Payment Processor, you are responsible for ensuring that your Merchants’ transactions are secure and compliant with the Payment Card Industry Data Security Standard (PCI DSS). By offering our White-Label PCI ASV Scanning solution to your Merchants, you can provide them with the tools they need to protect their customers’ data and meet the requirements of PCI DSS. By offering our White-Label PCI ASV Scanning solution to your Merchants, you can help them stay compliant and secure while also providing your organization with a profitable revenue stream. Our White-Label PCI ASV Scanning solution is designed to meet all the PCI Security Standards Council requirements and can be customized with your company’s branding.

Improve Customer Loyalty

By offering a comprehensive scanning service that is recognized by industry experts, you can differentiate your business from your competitors and improve your customer loyalty. You can now offer a high-quality, comprehensive PCI scanning service that is regulated by the PCI Council, and is specifically tailored to the unique needs of your Merchants. Our solution is easy to use with a self-managed web-based scanning portal or through our optional Application Programming Interface (API). This allows your Merchants to quickly schedule and run security scans without the need for technical expertise. This can help them identify any vulnerabilities that may exist in their systems, including malware infections, SQL injection attacks, and more. Help your merchants save time and money by identifying vulnerabilities before they can be exploited by cybercriminals.

Improve Security Posture

We provide threat intelligence and signature updates consistently updated from multiple security sources to protect against emerging threats and vulnerabilities. This means that your Merchants can stay ahead of the curve and protect their systems from the latest threats. In the event that any vulnerabilities are identified, our detailed remediation steps can assist your Merchants with resolving them quickly and efficiently. This will help them maintain compliance with PCI DSS, avoid fines, and maintain the trust of their customers. Offer PCI scanning as an added service to your Merchants, and generate additional revenue streams while also improving your customers’ security posture.

Safeguard Data and Achieve Compliance

Our White-Label PCI ASV Scanning solution can help you safeguard your Merchant’s data achieve compliance with PCI DSS, which is essential for any business that accepts credit card payments. This will also help you differentiate yourself from your competitors and increase customer loyalty. Having your own White-Label PCI ASV Scanning solution, is an essential tool for Payment Processors who want to provide a secure and compliant environment for their Merchants. By offering this required compliance service, you can differentiate your business from your competitors, generate additional revenue streams, and improve your customers’ trust and loyalty. Contact us today to learn more about how we can help you grow your payment processing business while providing essential security services to your Merchants.

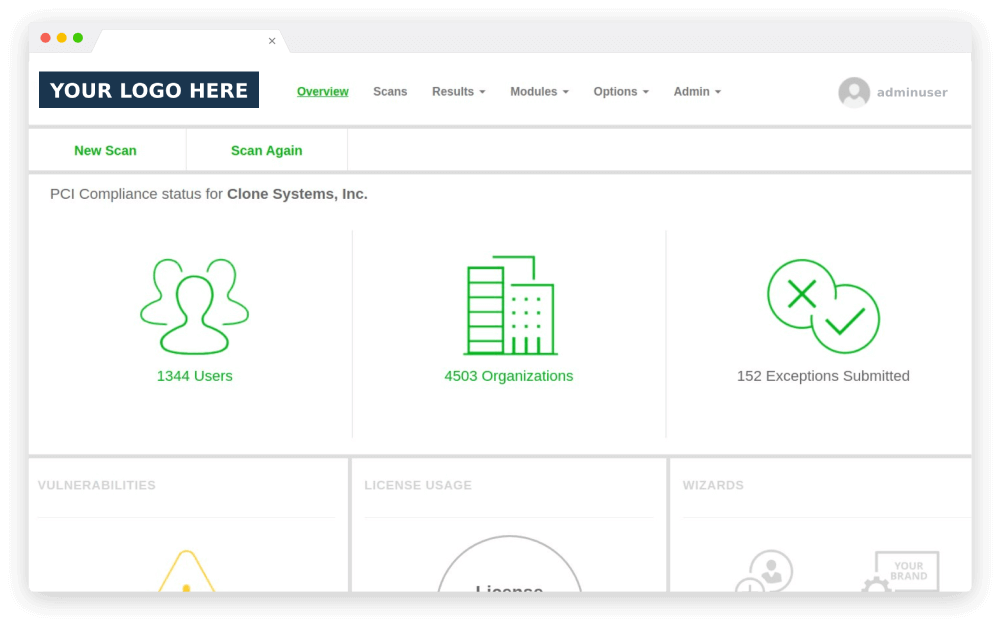

A PCI ASV solution that you can brand as your own

Robust PCI Security Scanning

A robust PCI security scanning solution that reflects your company’s branding from an Approved Scanning Vendor (ASV) that meets all the PCI Security Standards Council requirements

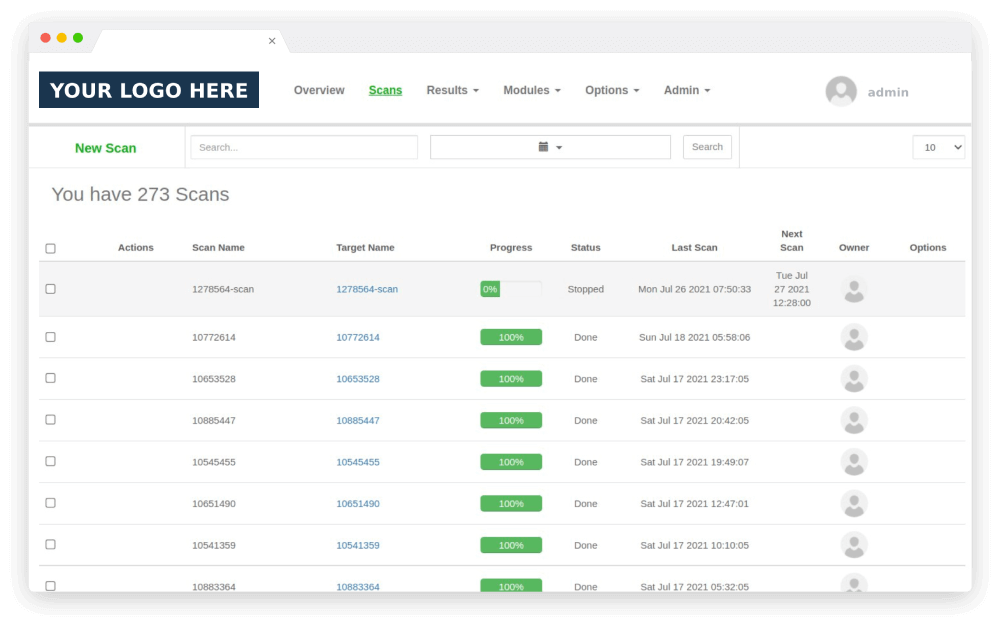

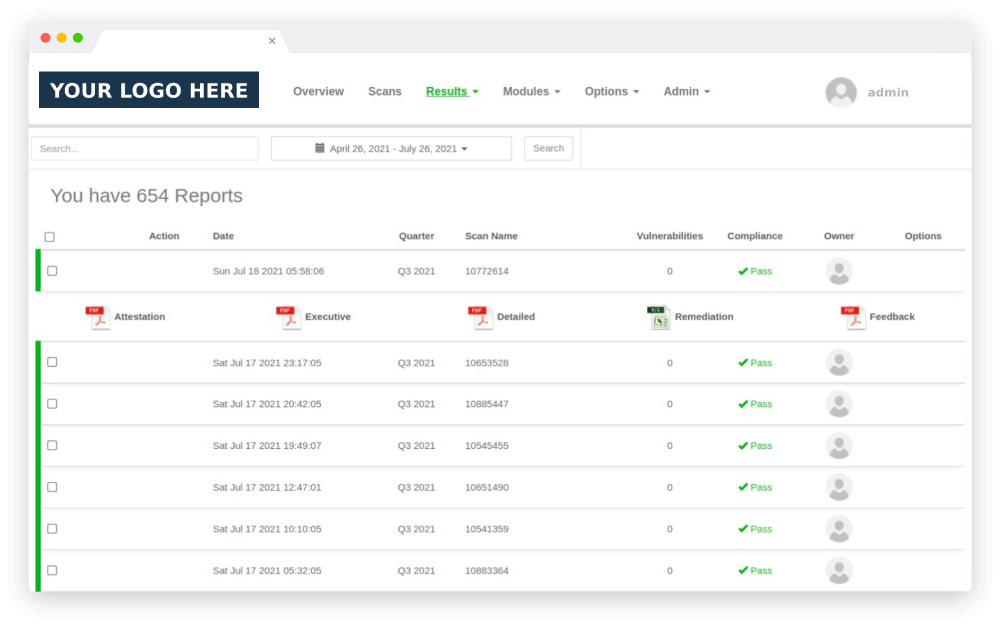

Easy to use web-based portal

Easy to use self-managed web-based scanning portal or Application Programming Interface (API) which enables your customers to quickly create, schedule and run security scans

Threat intelligence

Threat intelligence and signature updates consistently updated from multiple security sources to protect against emerging threats and vulnerabilities

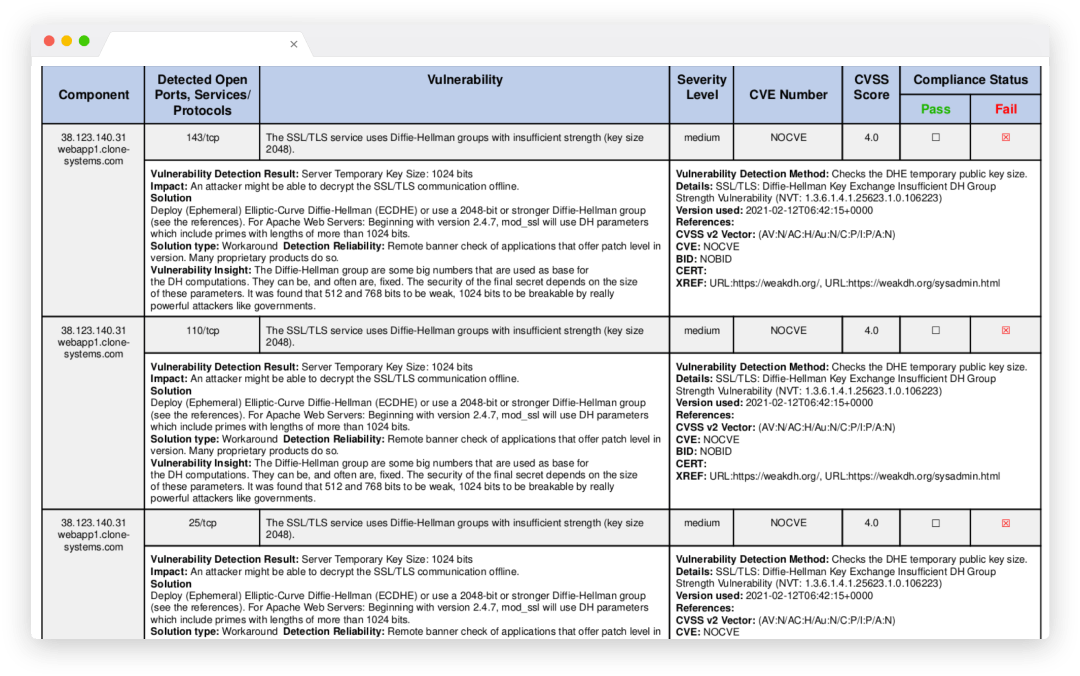

Detailed remediation steps

Detailed remediation steps that can assist your customers with resolving identified vulnerabilities

Reseller Benefits

Customer Benefits

Features

Branding

White-labeling and complete customization with Vanity URL

Multi-tenancy

Segment payment facilitators under hierarchical roles. Let them scan independently of manage the solution on their behalf

API Integration

Streamline operations with existing platforms

Scan Automation

Schedule scans and notifications

Attestation

Passing attestation upon successful remediation

Detailed Reports

Comprehensive vulnerability and remediation reports

Remediation Module

Track risk overtime through an action plan

Easy Exception Process

Quickly handle false positive vulnerabilities through the portal

Advanced Report combining

Combine multiple reports for a comprehensive view of website security

Flexible Licensing

Create custom packages based on Ips or number of payment facilitators

Dark web probing

Detect if company’s sensitive data has been exposed on the dark web

Reputation Enhancement Tool

Improve company’s online reputation

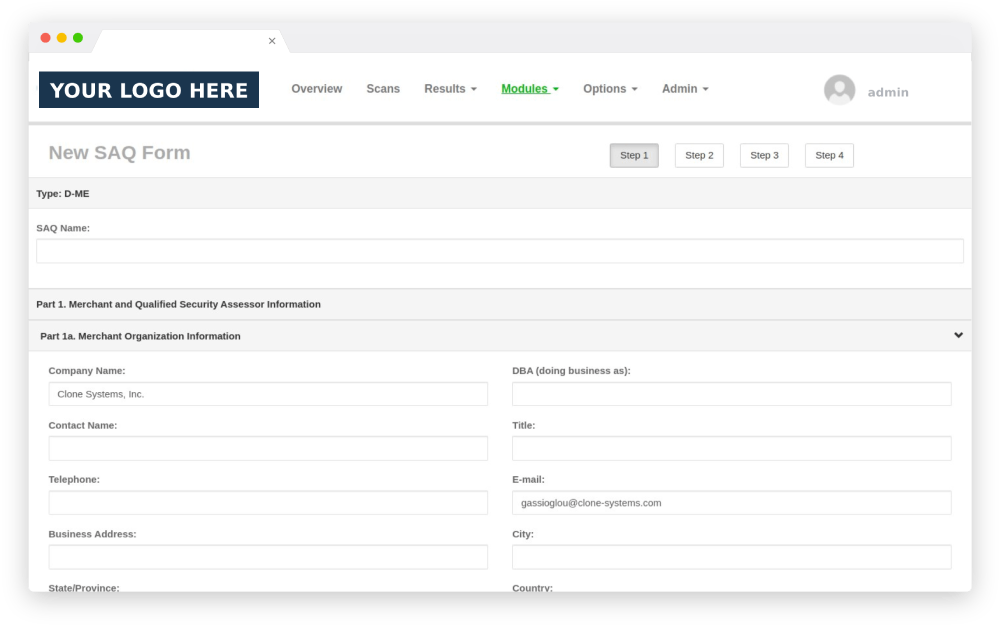

SAQ Wizard

Guides users in selecting the correct form type and simplifies the completion of the assessment with relevant questions and instructions

Schedule your Payment Processors

White-Label PCI Demo

No software to download or install.

Email us or call us at 1.800.414.0321.