The Quantum Clock Is Ticking: Why Payment Processors Must Start Preparing Now

Quantum computing is no longer a concept reserved for research labs. It is rapidly becoming a real-world technology with the power to disrupt the foundation of digital security as we know it. For payment processors, financial institutions, and organizations responsible for cardholder data, the implications are massive. The very encryption standards that currently secure the global payment ecosystem could become obsolete in just a few years.

At the center of this shift is the looming risk that quantum computers will soon be capable of breaking widely used encryption algorithms such as RSA and ECC. These encryption methods are built on the mathematical difficulty of factoring large prime numbers or solving discrete logarithms, problems that are practically impossible for today’s classical computers. But quantum algorithms, like Shor’s algorithm, can solve them exponentially faster. What would take current machines thousands of years could be solved by a quantum computer in hours.

That makes the timeline urgent. According to industry research, nearly two-thirds of cybersecurity leaders now view quantum computing as the most critical security threat they will face within the next five years. And sophisticated attackers are not waiting for the future to act. They are already executing “harvest now, decrypt later” strategies by collecting encrypted financial data today with plans to unlock it once quantum power becomes available.

This means that payment data being transmitted or stored right now, even if encrypted under current PCI-compliant standards, may already be vulnerable to future compromise.

Why the Payment Industry Is Especially at Risk

The payment industry depends on multiple layers of cryptography: TLS encryption for data in transit, tokenization for protecting card data, and digital signatures for authentication. Every one of these layers is at risk from a quantum attack.

If any party in the payment ecosystem, be it a card network, bank, or service provider, fails to prepare for this transition, the entire chain can be compromised. That is why quantum readiness must be viewed as an industry-wide effort, not a task reserved for security teams alone.

Post-Quantum Cryptography Is the Path Forward

Post-quantum cryptography (PQC) refers to a new class of encryption algorithms designed to resist attacks from both classical and quantum computers. In 2024, the National Institute of Standards and Technology (NIST) finalized its first set of quantum-safe cryptographic standards. These include lattice-based algorithms like CRYSTALS-Kyber for key exchanges and CRYSTALS-Dilithium for digital signatures, which are well-suited for high-speed payment environments.

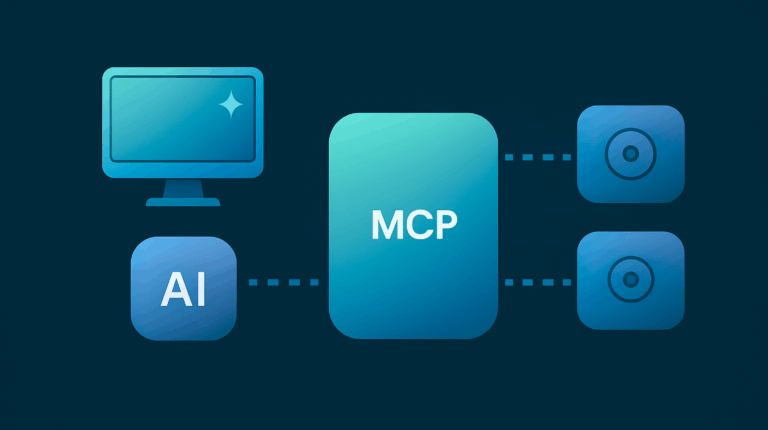

Many payment systems were not designed to be cryptographically agile, meaning they were built with fixed algorithms that cannot be easily swapped out. Upgrading to PQC requires not just a code change but a complete architectural review and a strategic roadmap for implementation. Organizations that act now can avoid disruption later and begin building systems that are flexible enough to adopt newer encryption methods as they evolve.

What This Means for PCI DSS and Compliance

As the industry adapts, so will compliance requirements. The Payment Card Industry Data Security Standard (PCI DSS) currently mandates strong encryption and secure key management. However, these standards were built with classical threats in mind. The PCI Security Standards Council has already started discussing post-quantum threats in its guidance documents. It is likely that future versions of PCI DSS will include quantum-resistant encryption as a requirement.

Waiting for the next official update is not a safe strategy. Organizations that begin planning for quantum-safe transitions today will be better positioned to meet new standards, maintain compliance, and avoid the expensive pitfalls of rushed implementation.

Hybrid Models Provide a Realistic Starting Point

One promising strategy is to implement hybrid encryption models that combine classical and quantum-resistant algorithms. These models provide current protection while preparing for future attacks, giving payment processors a way to gradually build resilience without risking service disruption.

Testing and validation are critical. Because PQC algorithms often come with different performance profiles and larger key sizes, payment processors must rigorously evaluate the impact on transaction speeds, bandwidth, and system compatibility. This is especially important in high-volume environments where even slight delays can hurt the customer experience.

The Business Case Is Clear

There is a strong business case for investing in quantum readiness now. Financial institutions that adopt PQC early can reduce long-term security risk, avoid compliance violations, and gain a competitive edge by demonstrating leadership in cybersecurity. Forward-thinking companies can market their quantum readiness as a differentiator to partners and customers who are increasingly aware of the risks.

Early adoption also allows organizations to take advantage of vendor support, government guidance, and industry working groups before the full pressure of regulation kicks in. For global payment providers, proactive planning means fewer surprises across jurisdictions with differing implementation timelines.

Start With a Cryptographic Inventory

A solid starting point is a full cryptographic inventory. Most organizations use encryption in dozens of different applications, often without centralized tracking. Understanding where and how your systems rely on quantum-vulnerable algorithms is the first step toward a successful migration.

From there, organizations should evaluate risk, prioritize systems based on exposure and sensitivity, and build in flexibility for future algorithm updates. Training internal teams, engaging vendors, and participating in industry collaboration groups are all key parts of a comprehensive quantum readiness strategy.

Conclusion: The Future Is Closer Than It Seems

Quantum computing will transform cybersecurity, and the payment industry is one of the most exposed. This is not just a technical issue, it is a business risk that requires immediate attention.

Organizations that wait may find themselves caught off guard when encryption failures lead to data breaches, regulatory penalties, or customer trust erosion. But those that prepare now can navigate the transition with confidence, positioning themselves as leaders in the next era of secure payment processing.